Buy Side M A Process Timeline

The seller will most likely calculate anticipated future cash inflows with.

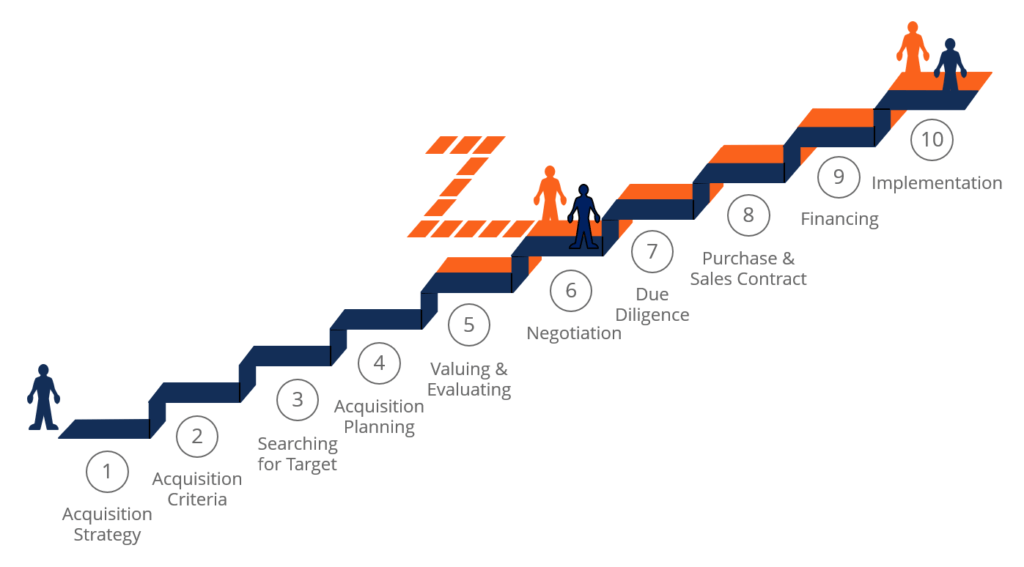

Buy side m a process timeline. Each side can begin to set a possible valuation for the sale. Compile a target list. In this post we walk through an m a process from start to finish. Private equity m a process timeline therefore i would like to assume the following scenario in order to illustrate the entire process.

A private equity funds the seller seeks to exit an investment in one of its portfolio companies. Financial buys discuss the importance of synergies hard and soft synergies and identify transaction costs. One of the first steps of buy side m a in a private equity transaction timeline is when the bankers send teasers to the private equity players. Included on this page you ll find a step by step process for buy side with templates a step by step process for sell side with templates best practices for executing an m a deal and key m a terminology.

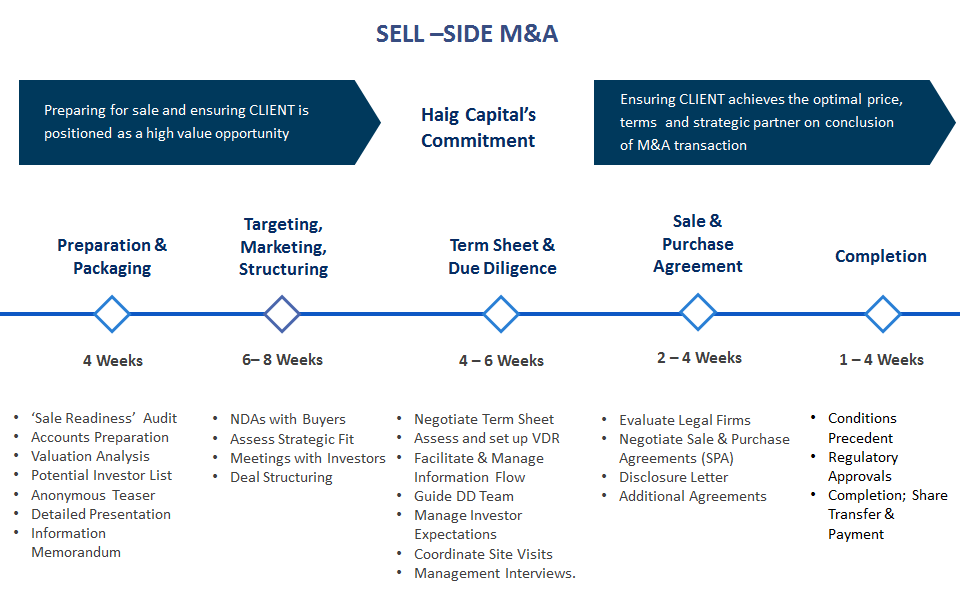

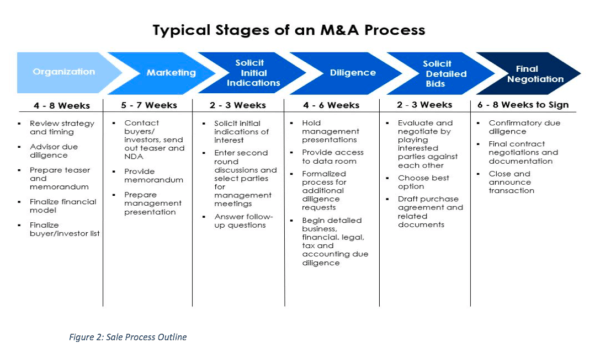

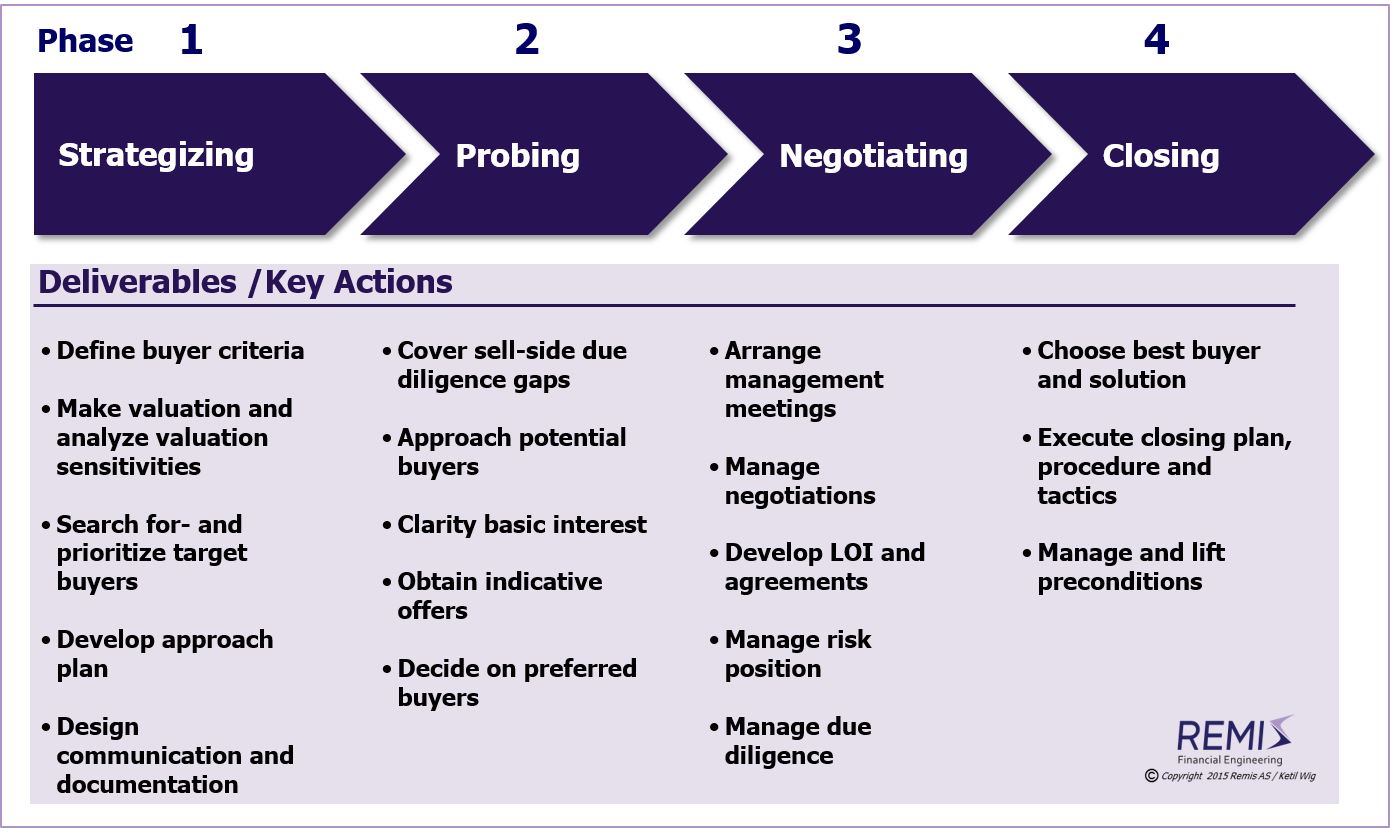

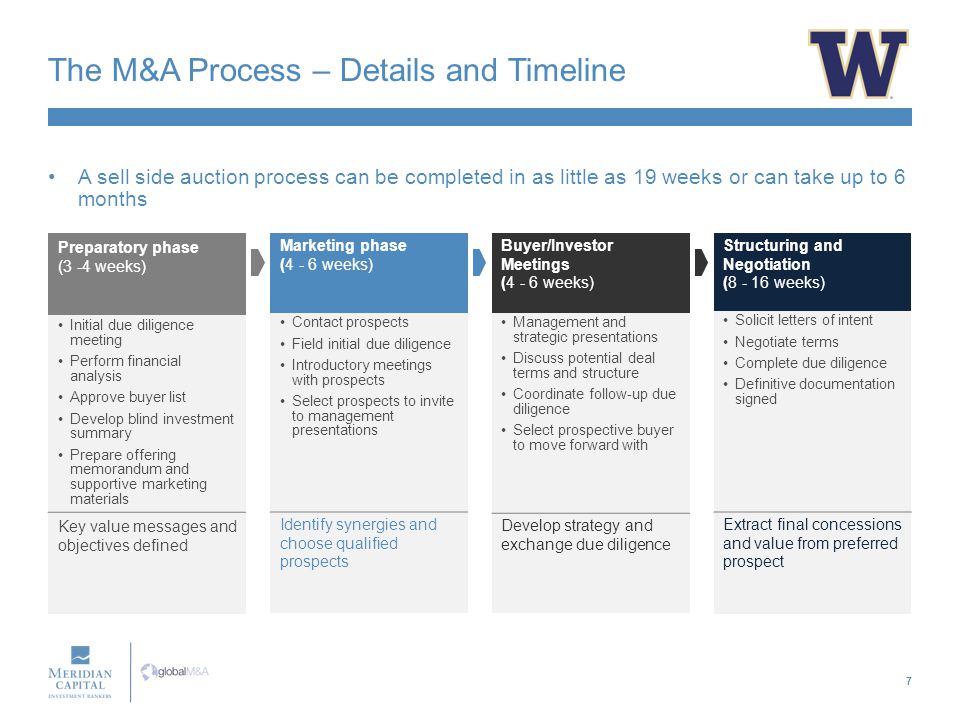

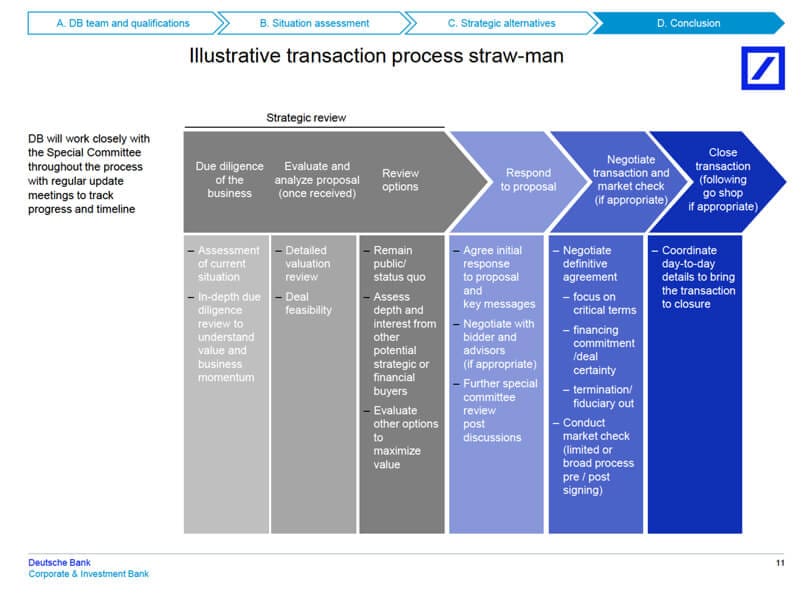

You can t buy or sell a business unless you have a list of suitable sellers or. The mergers and acquisitions m a process has many steps and can often take anywhere from 6 months to several years to complete. When the seller is running an auction process broad limited or even targeted the m a process is generally broken into four discrete stages. Here s the step by step process that nearly every m a deal follows.

To learn all about the m a process watch our. The m a process can start in a variety of ways. Teasers are documents that contains a brief description of the business its product and service offerings and financial highlights. Sell side auction process and timeline preparing for sale.

M a process summary teaser executive summary non disclosure agreement nda confidentiality agreement ca confidential information memorandum cim offering memorandum indication of interest expression of interest bid process letters round 1 first round bids letter of intent bidder selection bid process letters round 2. In this guide we ll outline the acquisition process from start to finish describe the various types of acquisitions strategic vs. Going through an m a deal can be an intimidating process for both the mergers and acquisitions teams but that process thankfully follows some concrete steps. In a m a context buy side ecompasses working with the buyers and finding opportunities for them to acquire other businesses.

The buy side process begins by raising the funds from the investors and then deciding where to invest and what to buy.